franchise tax bd cast tax

The Franchise Tax Board FTB is the California tax agency that collects and enforces state income tax assessment and collection. Help is available if you owe taxes but cant pay in full.

Different states have penalties for late payments of franchise taxes which the Franchise Tax Board will track and penalize corporations for.

. In Delaware the penalty for non-payment or late. Should I be upset. Find the best Tax Franchises in District of Columbia.

2d 288 residence for tax. See generally Superior Oil v. Use refund towards your estimated payments.

Franchise Tax Bd 60 Cal2d 406 386 P2d 33 34 Cal. This calculator does not figure tax for Form 540 2EZ. In many situations the FTB operates similarly to the Internal Revenue Service IRS.

W-4 IRS Withholding Calculator. You got a deduction benefit for it so now you have to include it as income. Please contact the moderators of this subreddit if you have any questions or concerns.

Refund is taxable if you itemized deductions on that prior years federal return and took a deduction for state income taxes instead of the sale tax. 3 You may receive a letter explaining the difference in a few days. I have a traffic ticket which I extended the court date 3 months later.

If youre looking for a form try forms and publications. In essence it is a tax that certain businesses pay for the right to operate within a states confines. You can also search our site by starting from the home page.

The page or form you requested cannot be found. Ach Credit Franchise Tax Bd Casttaxrfd I have just received a direct deposit for tax exemption. Use the 540 2EZ Tax Tables on the Tax Calculator Tables and Rates page.

The taxes are named differently depending on the state and some people. We just changed our entire website so we likely moved what youre looking for. The Golden State Stimulus aims to.

If you copied or typed in the web address make sure its correct. A Franchise Tax is a tax levied on certain enterprises in some states and is paid in addition to real estate taxes and income taxes. The franchise tax is a levy charged by the government in some US states for the privilege available to the entity to exist and operate within that particular state.

The Top Tax Preparation Franchises of 2022. Do not include dollar signs commas decimal points or negative amount such as -5000. I remember filing my tax return for 2015 and I had paid right on the money to CA I think I was owed a dollar or two back so there is no way this money is from that year.

FRANCHISE TAX BD CASTTAXRFD 022117 XXXXX5 1600 022417 Is this something from my tax return. California provides the Golden State Stimulus to families and individuals who qualify. Rates for Tax Year 2022 Tax Rates.

This tax is lower than I expected what does that mean. Allow at least 8 weeks to receive the new refund check. Whittell was a citizen of Nevada for purposes of diversity jurisdiction are not relevant to the determination of the Whittells 231 Cal.

This is a stimulus payment for certain people that file their 2020 tax returns. See generally Hearings on the Matter of the Unitary Tax before the Cal. Simply browse our directory to find your ideal franchise or business opportunity.

I think in 2013 I did end up owing right around the amount that was deposited to the state and I paid it on some. Franchise Tax Board PO Box 942867 Sacramento CA 94267-0001. Contact us about refunds Phone 800 852-5711 916 845-6500 outside the US Weekdays 8 AM to 5 PM Chat.

If you havent filed your income taxes yet visit estimated tax payments. It seems like theres at least one in even the smallest cities and towns. It says FRANCHISE TAX BD DESCASTTAXRFD which google slething tells me is a CA state tax refund.

A prior finding by the Franchise Tax Commissioner that respondents were not residents of California in 1935 1937 and 1938 and the federal courts adjudication in 1936 that Mr. There are many similarities between issues that arise with federal income taxes and those that arise for California state income. Customers can get tax help from the company in person at any of their storefront locations or online with an HR Block Tax Pro.

For assistance with MyTaxDCgov or account-related questions please contact our e-Services Unit at 202 759-1946 or email e-servicesotrdcgov 815 am. Support low and middle income Californians. The undersigned certify that as of July 1 2021 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with California Government Code Sections 7405 and 11135 and the Web Content Accessibility Guidelines 21 or a subsequent version as of the date of certification published by the Web.

Required Field California taxable income Enter line 19 of 2021 Form 540 or Form 540NR Caution. Some states only tax corporations. However the vast majority will tax businesses no matter the form of the business.

The tax is levied on net worth or capital of the entity and not on the income earned by the entity. The tax rates for tax years beginning after 12312021 are. HR Block is the undisputed king of tax preparation franchises.

This also happened to me. The undersigned certify that as of July 1 2021 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with. I am a bot and this action was performed automatically.

Technically I shouldnt have been guilty and I am fighting for it. A franchise tax is a specific type of taxation that involves a certain type of business. 545 1963 and Appeal of Signal Oil 1966-1971 Transfer Binder CAL.

Some US states have different kinds of a taxes on business income. July 12 and August 22 1977 on file at Santa Clara Law Review. Individual and Fiduciary Income Taxes The taxable income of an individual who is domiciled in the District at any time during the tax year or who maintains an abode in the District for 183 or more days during the year or of a DC estate or trust is subject to tax at the following rates.

Either you made a mistake or the FTB withheld some money from the state or local government to meet other obligations. For most Californians who qualify you do not need to. Anytime access to your tax account MyFTB gives you 247 access to your tax account information and online services.

Help those facing a hardship due to COVID-19. The undersigned certify that as of July 1 2021 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with California Government Code Sections 7405 and 11135 and the Web Content Accessibility Guidelines 21 or a subsequent version as of the date of certification published by the Web.

Ach Credit Franchise Tax Bd Casttaxrfd How To Discuss

Wonderchef Royal Velvet Purple Set Non Stick Cookware Online In India

Ghostbusters Afterlife Bilingual Bd Dvd Combo Digital Blu Ray Amazon Ca Carrie Coon Finn Wolfhard Mckenna Grace Bokeem Woodbine Paul Rudd Logan Kim Celeste O Connor Bill Murray Dan Aykroyd Ernie Hudson Annie Potts Sigourney

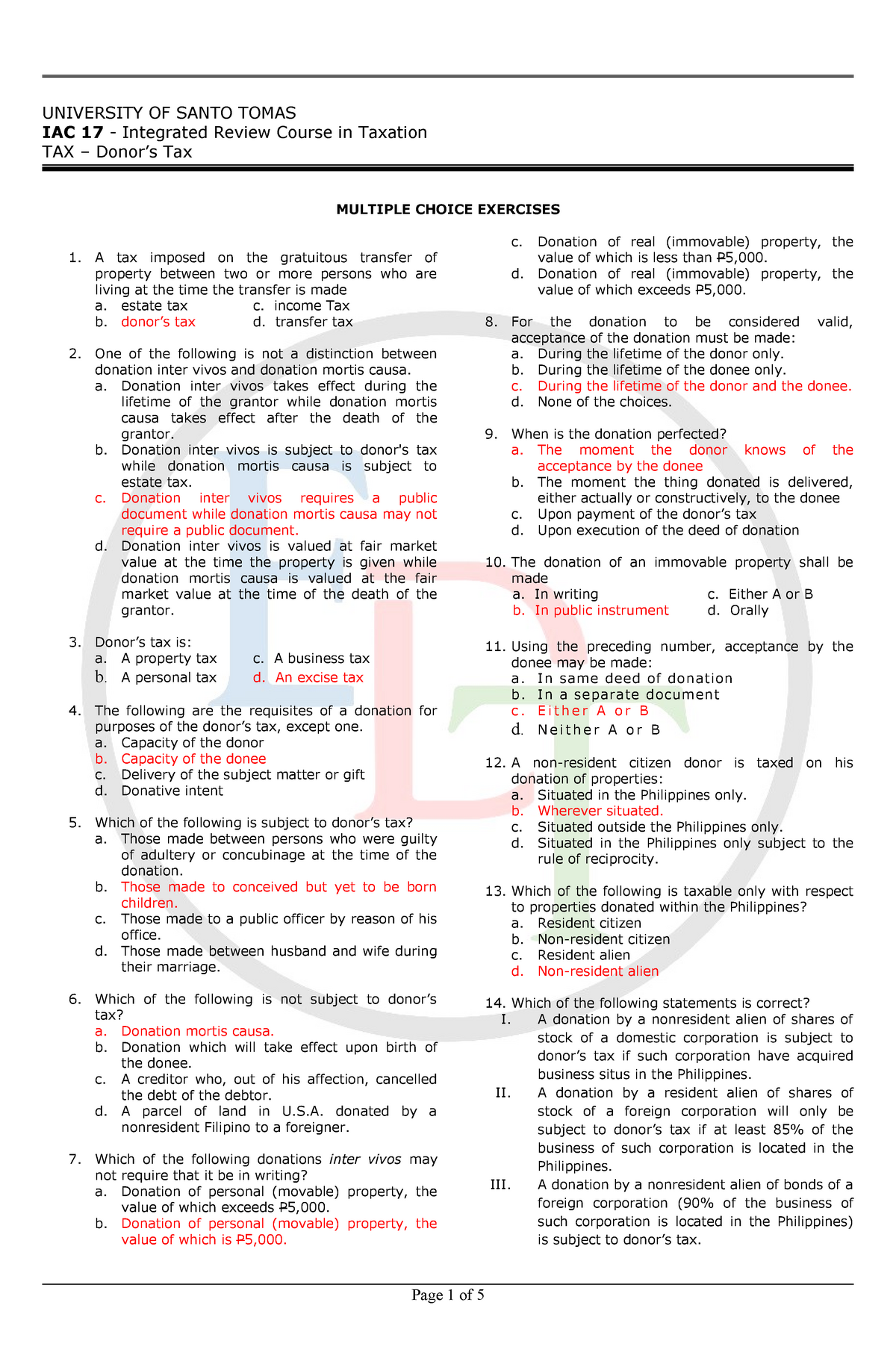

Donor S Tax Exam Answers University Of Santo Tomas Iac 17 Integrated Review Course In Taxation Studocu

First Look At Shia Labeouf In David Ayer S The Tax Collector Shia Labeouf Shia New Movies